Budgeting Tips for the Sandwich Generation: Balancing Care for Kids and Parents

Imagine juggling the financial responsibilities of raising children while supporting aging parents—welcome to the world of the Sandwich Generation!

This unique group of individuals faces the challenge of managing the needs of two generations simultaneously, often leading to significant financial stress.

Effective budgeting becomes essential in navigating these dual responsibilities without compromising financial stability.

Here are practical budgeting tips for the Sandwich Generation, focusing on assessing financial needs, creating a comprehensive budget, finding cost-saving strategies, and seeking financial advice.

Assessing Financial Needs

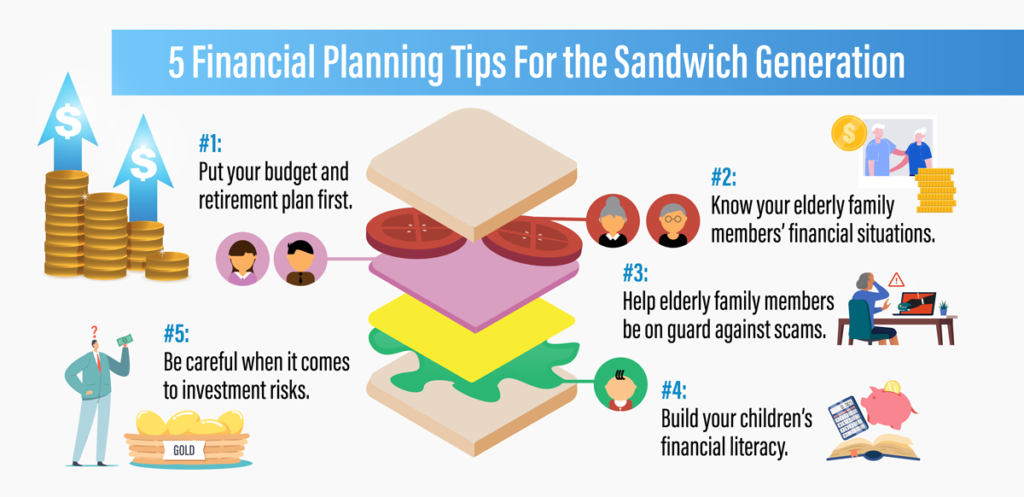

The first step in creating an adequate budget is to thoroughly assess the financial needs of both your children and elderly parents. You can begin by identifying and prioritizing these needs, including education costs, healthcare expenses, daily living costs, and any special requirements specific to either generation. For example, children’s needs might involve school fees, extracurricular activities, and future college savings, while your parents may require medical care, prescriptions, and assistance with daily living.

Tracking expenses is crucial to clearly understanding where your money is going. Use a spreadsheet or a budgeting app to categorize the costs, making it easier to identify patterns and areas where you can cut back.

Evaluate all sources of income and available resources, such as pensions, social security benefits, and any government or community assistance programs that might be available for elderly care.

Understanding the complete picture of your financial situation allows you to make informed decisions and prioritize spending effectively.

Achieving balanced financial living begins with aligning your mindset with your goals, and Croix Sather’s “Instant Manifestation Secrets” provides the perfect blueprint to make this a reality.

This groundbreaking program empowers you to unlock your subconscious potential and tap into the universe’s energy to manifest wealth, abundance, and financial stability.

Through its easy-to-follow techniques, you’ll reprogram limiting beliefs, shift your focus toward prosperity, and take inspired action to create lasting change.

Whether you’re seeking to clear debt, build savings, or achieve financial freedom, “Instant Manifestation Secrets” offers a powerful, practical pathway to balance and abundance in every area of your financial life.

Creating a Comprehensive Budget

Once you clearly understand your financial needs, the next step is to create a comprehensive budget.

Start by setting both short-term and long-term financial goals that accommodate the needs of both generations. Short-term goals might include paying off debt or saving for an upcoming school event, while long-term goals could involve building an emergency fund or planning for retirement.

Allocate funds appropriately within your budget to ensure that essential needs are met first. This includes basic living expenses, healthcare, and education. Use budgeting tools and apps to streamline the budgeting process and keep track of expenses in real time. Apps like Mint, YNAB (You Need a Budget), or even simple spreadsheet templates can help you monitor spending and adjust your budget as needed.

Regularly reviewing and adjusting your budget is crucial to staying on track and meeting your financial goals.

Finding Cost-Saving Strategies

Cutting unnecessary expenses is a practical way to ease financial pressure. Start by identifying areas where you can reduce spending, such as dining out less frequently, canceling unused subscriptions, or opting for generic brands instead of name brands. Small changes can add up to significant savings over time.

Maximizing benefits from insurance policies, tax deductions, and employer benefits can also help alleviate financial pressure. Review your insurance policies to ensure you are not overpaying and take advantage of any tax deductions related to caregiving or education.

Additionally, look into employer benefits such as flexible spending accounts (FSAs) or health savings accounts (HSAs) that can provide tax advantages.

Seek out discounts, grants, and assistance programs specifically designed for families and caregivers. Many organizations offer childcare subsidies, senior care programs, and other forms of financial assistance that can help reduce your overall expenses.

Research local and national resources to find programs you qualify for and take advantage of these opportunities to save money.

|

|

Balancing the financial responsibilities of caring for children and aging parents is a challenging but manageable task with the right strategies.

By assessing financial needs, creating a comprehensive budget, finding cost-saving opportunities, and seeking professional advice, you can navigate the complexities of being part of the Sandwich Generation.

Remember, effective budgeting ensures financial stability and allows you to provide the best care for your loved ones while securing your own financial future for a more balanced and abundant life!

I will immediately seize your rss as I can not find your e-mail subscription hyperlink or

e-newsletter service. Do you’ve any? Kindly let me recognise in order that

I may just subscribe. Thanks.

Hello! My new blog posts are scheduled to appear on the first day of each month. I also have a weekly email called, “Balanced Abundant Living: Information Tools for Your Life’s Journey”. I would need your permission to add your email to receive it. It is a free service.

Greetings! Very useful advice within this article! It is the little changes that

will make the most important changes. Thanks a lot

for sharing!

You’re so welcome!

Its not my first time to visit this site, i am browsing this

site dailly and get fastidious data from here daily.

Thank you so much for your positive feedback.